Scandal-hit firm 'called police' after complaint

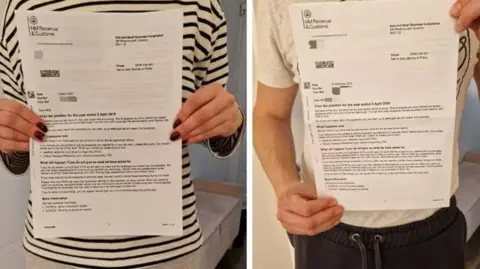

BBC/Stephen Huntley

BBC/Stephen HuntleyA company at the centre of a tax rebate scandal called the police after a client complained, court papers have revealed.

About 800 people were left with large bills after making claims through Apostle Accounting, based in Stowmarket, Suffolk, and receiving money to which they they were not entitled.

One former client who lost an appeal at a tribunal against HM Revenue and Customs (HMRC) over its efforts to recover more than £3,500, said Apostle had responded that "police have been informed of threats and harassment".

The BBC has sent requests for comment to the former directors of Apostle.

The former client, Dennis Lucas, a UPS driver from Camberwell in south London, contacted Apostle after being told about the company by work colleagues.

They had received thousands of pounds in "tax rebates" relating to the cleaning of uniforms and subsistence expenses, he said.

The tribunal judgement recorded how Apostle "did not ask for, nor did Mr Lucas provide, any details of income or expenses or receipts".

He was unaware of what had been claimed on his behalf - but Mr Lucas lost his case as the tribunal found HMRC had acted correctly when it sought to recover the money.

"We have a great deal of sympathy for Mr Lucas who was misled by Apostle into authorizing claims which he believed to be legitimate, but which Apostle knew were not. However, we must apply the law as it stands," the judgement stated.

Mr Lucas estimates that about 200 UPS colleagues had been in contact with Apostle.

"There's a lot of embarrassment," he said. "I should imagine it has caused conflicts in relationships."

He added that he would struggle to repay the money back to HMRC.

"The impact will ultimately be debt. A loan will have to be taken out to cover the payments or a credit card," Mr Lucas said.

He confirmed that there was no police contact after Apostle's letter claiming they had reported him.

Mr Lucas said he was "bitter" and that he was "really upset with the tribunal's decision".

The judgement included an email sent by Apostle to Mr Lucas, after he had complained to the company.

It said: "The police have been informed of your threats and harassment and so has our solicitor."

Mr Lucas told the BBC the police had not spoken to him.

The letter was "factually inaccurate and threatening" according to the tribunal.

The directors of Apostle Accounting, Zoe and Martin Goodchild, have so far not responded when contacted about this.

Previously Ms Goodchild - who now appears to use the name Zoe Payne - had denied any wrongdoing.

'Acted deliberately'

Former Apostle clients collectively ended up owing millions of pounds back to HMRC according to calculations seen by the BBC.

The company has since been wound up and is currently in liquidation.

This latest judgement from the Upper Tier Tax Tribunal said it had "little doubt that Apostle acted deliberately in submitting tax returns containing the excessive and unallowable expense claims".

Tax Policy Associates

Tax Policy AssociatesTax lawyer Dan Neidle, who has highlighted the tribunal judgement to his social media followers, told the BBC: "The judge saw an email trail which made clear that Apostle submitted false claims without their client's authority.

"Sadly today anyone can call themselves a tax agent and file a tax return - and you're responsible if they get it wrong, even badly wrong."

"So I would advise only using an agent that's regulated by one of the accounting or tax bodies - the Chartered Institute of Taxation (CIOT), The Association of Taxation Technicians (ATT) or the Institute of Chartered Accountants in England and Wales (ICAEW)".

A police inquiry into the scandal has now entered its third year.

In 2024, officers from the Eastern Region Special Operations Unit (ERSOU) carried out searches of a commercial unit and two residential homes in Stowmarket as well as an office in Peterborough.

In a new statement, a spokesman for ERSOU said: "Our enquiries remain ongoing in relation to allegations of fraud involving a business in Stowmarket, Suffolk, and investigators are working closely with partner agencies to establish what offences may have been committed.

"Anyone who believes they have been defrauded is encouraged to report it by contacting Action Fraud online at www.actionfraud.police.uk or by calling 0300 123 2040."

HMRC said it does not comment on individuals or companies.

Follow Suffolk news on BBC Sounds, Facebook, Instagram and X.