House prices rose by 4.7% in 2024, says Nationwide

Getty Images

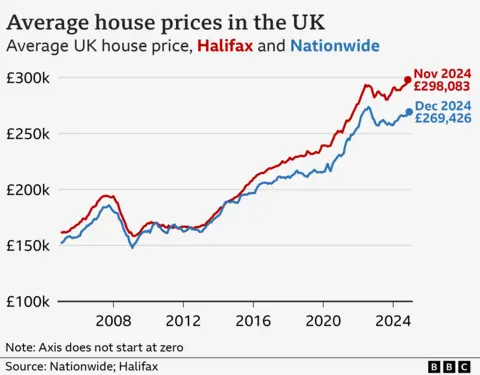

Getty ImagesUK house prices ended 2024 some 4.7% higher than at the start of the year, according to the Nationwide.

Property prices and housing market activity remained "remarkably resilient" despite affordability challenges facing buyers, the lender said.

The average home in the UK cost £269,426 at the end of December, its figures show.

Despite the latest rise, the average cost remains below the peak seen in the summer of 2022.

The Nationwide, the UK's biggest building society, said prices of terraced homes rose fastest during the year.

Northern Ireland saw the fastest price growth, its mortgage data shows, with values also rising faster in northern England than in the south, although all regions saw an increase.

Changes in 2025

A lack of certainty over interest and mortgage rates, as well as upheaval caused by changes to stamp duty, could make 2025 difficult to navigate for buyers and sellers.

Housing experts predict the market will see the number of sales increase over the next few months, ahead of the stamp duty changes scheduled for April, before falling away afterwards.

House buyers in England and Northern Ireland will start paying stamp duty on properties over £125,000, instead of over £250,000 at the moment.

First-time buyers currently pay no stamp duty on homes up to £425,000, but this will drop to £300,000 in April.

There are also widespread expectations that the Bank of England will gradually reduce interest rates throughout the year, possibly starting in February, giving confidence to lenders to cut the cost of new fixed mortgage deals.

However, Bank of England governor Andrew Bailey recently said "the world is too uncertain" to make accurate predictions of when interest rates would fall, and by how much.

Robert Gardner, Nationwide's chief economist, said that house prices remained high relative to average earnings at the start of 2024, which meant that raising a deposit was tough for prospective first-time buyers.

"This is a challenge that had been made worse by record rates of rental growth in recent years, which has hampered the ability of many in the private rented sector to save," he said.

And Holly Tomlinson, financial planner at investment firm Quilter, said: "The looming changes to stamp duty are likely to make purchasing even more difficult for first-time buyers, adding further costs at a time when every penny counts."

Interest rates outlook

Some lenders have predicted that falling mortgage rates and rising wages should improve housing affordability during this year.

UK Finance, the lenders' trade body, has forecast a 10% rise in mortgage lending for house purchases during 2025, although some analysts have already questioned this prediction as optimistic for lenders.

Further ahead, it is expected many people will again find it tough to afford to move or buy a new home in 2026.

Eight in 10 mortgage customers have fixed-rate deals. The interest rate on this kind of mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it.

Even if mortgage rates fall this year, rates will still remain higher than many homeowners are paying on the current fixed deal.

The Bank of England estimated that about 4.4 million mortgage holders are expected to see payments rise by 2027.

It said a typical owner-occupier coming off a fixed rate in the next two years would see their monthly mortgage repayments increase by around £146.

Nationwide's house price data is based on its own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

Rival lender, the Halifax, will publish its final 2024 data in the coming days.