Young and in the red: Personal debt in five charts

Borrowing on loans, overdrafts, credit cards and car finance has accelerated since 2011.

Although it peaked in November last year, the annual rate of growth of so-called consumer credit remains close to double-digit levels.

1: Consumer credit remains high

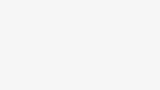

2: PCP agreements have increased five-fold since 2008

One reason for this trend is the fashion for Personal Contract Purchase, or PCP, agreements when buying a car.

This product, imported from the US, effectively means borrowers rent the car and the monthly payments cover the depreciation of its value over time. Obviously, this still counts as a loan.

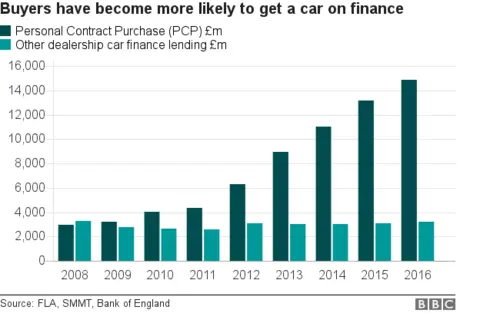

3: Balance transfer deals have got longer

Another signal of the greater availability of credit over time is the competition between credit card companies over 0% balance transfer deals.

A balance transfer effectively allows a borrower to use a new credit card to pay off debt on another credit card. The length of time that the amount borrowed is interest-free has been increasing.

Failing to meet a repayment deadline can leave people in a serious spiral of debt, charities warn. The Bank of England has also expressed concern.

4: The young are more likely to buy essentials on credit

All this has left some young people with serious concerns that they will struggle to pay off debts.

Some campaigners say that the availability of credit, alongside a squeeze in wages, has led these young adults to turn more readily than the older generation to credit to buy day-to-day essentials. One in five 25-to-34-year-olds admitted doing this in the past six months, according to research by PWC, compared with 6% of the over-55s.

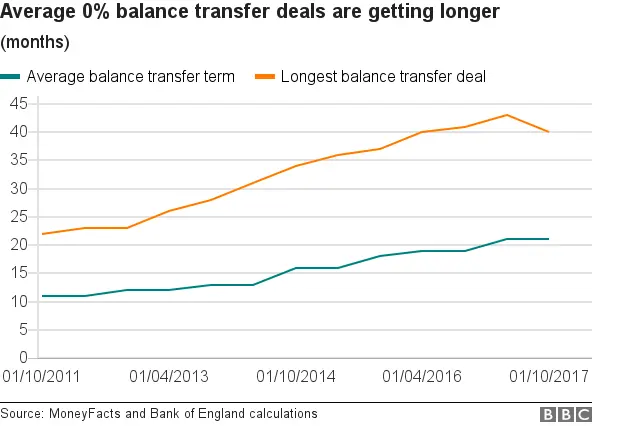

5: Seaside towns top the list of insolvency hotspots for the young

Those carrying the heaviest financial burden may eventually find their debts are unmanageable and choose to go insolvent.

There are various options, the most well-known of which is bankruptcy. All can have long-term implications for borrowing, ranging from buying a house to getting a mobile-phone contract.

The prevalence of young people going insolvent is higher in some areas of the country, with a couple of seaside towns topping the list.