Debenhams rejects Mike Ashley's last-ditch rescue plan

PA

PASports Direct says Debenhams has rejected its offer to inject £150m into the troubled department store chain.

Retail tycoon Mike Ashley tabled the rescue bid on the condition that he be made chief executive of Debenhams.

He has been locked in an acrimonious battle with Debenhams' board for control of the business and has accused its executives of "a sustained programme of falsehoods and denials".

Debenhams' rejection means it is likely to go into administration this week.

The firm is set to go through a pre-pack administration, which would mean current shareholders - including Mr Ashley who owns nearly 30% of the chain - would be wiped out.

While the shops would continue trading for now, Debenhams has proposed closing around 50 branches from next year and renegotiating rents with landlords to tackle its funding problems.

Takeover offer

In a statement, Sports Direct said it was "disappointed" with the response to its proposal to raise £150m by issuing new shares, which would also have seen lenders write off £148m of the chain's debt.

But the retailer said it was still giving "active consideration" to a separate offer, first proposed in March, to take over Debenhams by purchasing existing shares.

Press Eye

Press Eye

It's been an extraordinary tussle for control of Debenhams.

Barring a last minute twist, Mike Ashley has found himself on the losing side. His latest 11th hour proposal has been rejected by lenders.

The retailer doesn't have much choice.

It has £560m of debt and its creditors are now effectively calling the shots. Despite nearly £3bn of sales last year, the business is now worth less than £30m as its share price has crashed to less than 2p.

The board believes the best option is to be rescued by its lenders. This is set to take the form of a pre-pack administration. An announcement could come as early as Tuesday.

It will be business as usual for its shops and staff. But store closures down the line are inevitable. Debenhams has already said it needed to shut 50 stores in the coming years. That plan will now be accelerated, with up to 20 expected to go in early 2020 through a restructuring process with landlords.

Lie detector

On Sunday, in its latest swipe at Debenhams management, Sports Direct called for an investigation and for the firm's shares to be suspended.

A strongly-worded statement accused Debenhams' board members of misrepresenting what had happened in a meeting between the two firms and urged them to undergo lie detector tests.

The struggling department store, which has 165 stores and employs about 25,000 people, reported a record pre-tax loss of £491.5m last year.

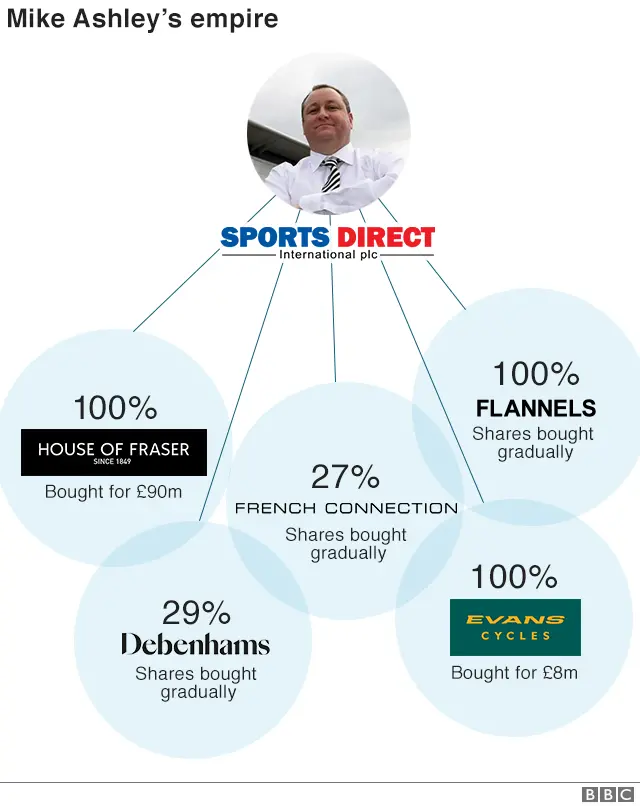

If Mr Ashley does gain control of Debenhams, he would control yet another High Street name.

As well as Sports Direct, Mr Ashley runs House of Fraser, Evans Cycles and Flannels.

In January, Mr Ashley joined investor Landmark Group to vote the chairman and chief executive of Debenhams off the board.

High Street retailers have been under increasing pressure as more people choose to shop online and visit stores less.