Coronavirus prompts LV to suspend travel cover

Getty Images

Getty ImagesA well known insurance brand has temporarily abandoned selling travel insurance as a result of the spread of coronavirus.

LV= said it had decided to stop selling the cover rather than hike prices.

The company said it had seen a doubling in the number of policies sold over the last couple of weeks, as travellers rush to protect themselves.

People who have already bought travel insurance from LV= will still be covered.

LV=, which used to be known as Liverpool Victoria, has more than 5 million policyholders, mostly with home or motor cover.

The company, which has its headquarters in Bournemouth, said, "In light of the impact that Coronavirus (COVID-19) is having globally, we've made the difficult decision to pause the sale of travel insurance to new customers."

LV='s move comes after one the UK's biggest insurers, Aviva, restricted the level of cover in new policies.

"It's very alarming that LV have withdrawn the sale of travel insurance and that other providers have also started restricting the policies they offer customers," said Gareth Shaw, head of money at Which?.

"Anyone planning a holiday should get insurance as soon as they book. If you haven't already booked insurance and are travelling soon we urge you to get cover immediately from a reputable insurer.

"The government, insurers and the travel industry must immediately tackle the huge challenge provided by coronavirus, as the industry depends on people having the confidence that they can travel with the knowledge they will be covered".

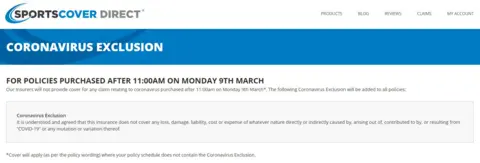

The biggest online seller of insurance for sports holidays, Sportscover Direct, has introduced a "coronavirus exclusion" in its policies.

Holidaymakers are anxious to protect themselves against having to cancel trips or being stuck overseas, so there has been a sharp increase in travel insurance sales across the industry.

At the same time providers face possible future costs which could escalate rapidly.

LV= added: "We considered a number of different options, such as excluding cover or significantly increasing prices for new customers. We strongly believe this temporary measure of pausing the sale of new policies and focusing on our existing customers is the right decision."

It said the decision to withdraw was due to exceptional circumstances and would kept under review.

Although insurers will honour their commitments in policies already sold, there is growing concern that it will become harder for holidaymakers to find good value cover.

Aviva says that people will still be able to buy its travel insurance - but they will not be able to add cover for travel disruption.

Getty Images

Getty ImagesA spokesperson said: "We have decided to adjust our cover to reflect the current risks posed by coronavirus."

The news comes as airlines cancel thousands of flights worldwide.

Aviva customers who bought travel insurance before Monday still have the full level of cover.

But if the UK Foreign Office advises against travelling to further countries, a new Aviva policyholder would now not be able put in a claim under the travel disruption clause.

Instead the customer would have to wait to see if airlines cancelled flights, then try to put in a claim under a different clause called "abandonment". That would cover costs which couldn't be recovered from the airline.

How do I get home?

If you are stuck in a country which becomes subject to a Foreign Office warning, you would not be covered by a new Aviva insurance policy for return tickets.

You would have to rely on your airline to get you back.

In practice, many travellers may find that they are looked after by their carriers.

If you are on a package holiday, the tour operator should offer a refund or a rebooking, or get you home.

'Unforeseen and unexpected'

The retreat from offering travel cover shows the level of concern in the insurance industry about the rising cost of dealing with travel problems caused by the outbreak.

Aviva said in its statement: "Insurance is designed to provide cover for unforeseen and unexpected events and is priced on this basis.

"The outbreak of the coronavirus means there is an increased likelihood of disruption to people's travel plans."

One specialist travel insurance provider, Sportscover Direct, has announced a "coronavirus exclusion" from this week, which will apply to newly-sold policies.

Lora Jones - News Analysis

Lora Jones - News AnalysisA message on its website said that from now on its insurance "does not cover any loss, damage, liability, cost or expense of whatever nature directly or indirectly caused by, arising out of, contributed to by, or resulting from Covid-19."

Sportscover Direct claims to be the UK's largest online specialist sports insurance provider, selling cover for ski and mountaineering trips and a range of extreme sports.

Other insurers, including AXA UK or the RSA, are still offering more comprehensive travel cover.