When will UK interest rates fall, making mortgages cheaper?

BBC

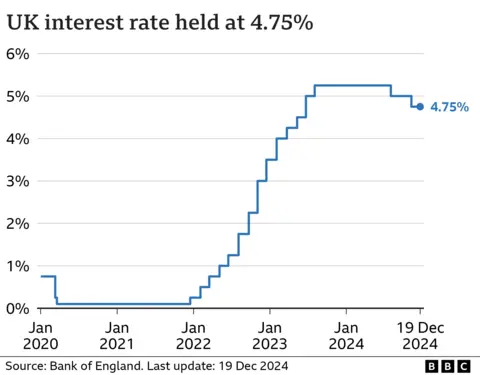

BBCThe Bank of England has held interest rates at 4.75% in December - following two falls in 2024.

Interest rates affect the mortgage, credit card and savings rates for millions of people across the UK.

The first drop in rates for more than four years came in August, followed by another in November. Some analysts predict another cut in February, although borrowing costs remain high for many.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England's base rate is what it charges other lenders to borrow money.

This influences what they charge their customers for loans such as mortgages, as well as the interest rate they pay on savings accounts.

The Bank moves rates up and down in order to control UK inflation - which is the increase in the price of something over time.

When inflation is high, it may decide to raise rates to bring inflation back down towards its 2% target.

The idea is to encourage people to spend less and reduce demand.

Once inflation is at or near the target, the Bank may hold rates, or cut them.

When will UK interest rates go down further?

In August 2024, the Bank rate fell to 5% after many months at 5.25% - which was the highest level for 16 years.

In November, a second cut took rates to 4.75%.

However, interest rates were significantly above this for much of the 1980s and 1990s, and up to the 2008 financial crisis, after hitting 17% in November 1979.

Inflation is also now far below the peak of 11.1% reached in October 2022.

The main inflation measure, CPI, rose by 2.6% in the 12 months to November 2024 which was up from 2.3% in October.

That means inflation is back above the Bank's target. But generally, prices are rising at a much slower rate than in 2022 and 2023.

The Bank also considers other measures of inflation when deciding how to change rates, such as price rises in different parts of the economy like the services sector - which includes everything from restaurants to hairdressers.

It has to balance the need to slow price rises against the risk of damaging the economy, and avoid cutting rates only to have to raise them again shortly afterwards.

How much could interest rates fall?

It is difficult to predict exactly what will happen to interest rates as it depends whether inflation remains consistently at or below the Bank's target.

The government's plans to borrow and spend billions which were set out in Chancellor Rachel Reeves' October's Budget have changed expectations.

Financial markets and the Bank itself now expect rates to be cut more slowly than previously anticipated.

The OECD think tank has also predicted that rates will be higher for longer due to the Budget.

Donald Trump's victory in the US presidential race could have an impact on prices globally because of his plans to introduce tariffs on imports.

Some estimates suggest this could cost the UK billions, the risk of which is likely to influence the Bank of England's decision-making in the coming months.

Similarly some retailers have suggested prices could rise and jobs are at risk after the Budget announcement that they will have to pay more National Insurance for their staff, which could also affect the economy.

Announcing the December rate decision, Bank of England governor Andrew Bailey said: "We think a gradual approach to future interest rate cuts remains right."

But he said due to heightened uncertainty in the economy the Bank "could not commit to when or by how much we will cut rates in the coming year".

The next interest rate announcement is in February.

How do interest rates affect me?

Mortgage rates

Just under a third of households have a mortgage, according to the government's English Housing Survey.

About 600,000 homeowners have a mortgage that "tracks" the Bank of England's rate, so a base rate change would have an immediate impact on monthly repayments.

But more than eight in 10 mortgage customers have fixed-rate deals. While their monthly payments aren't immediately affected, future deals are.

Mortgage rates are still much higher than they have been for much of the past decade.

The average two-year fixed mortgage rate is 5.46%, according to financial information company Moneyfacts, and a five-year deal is 5.23%.

It means many homebuyers and those remortgaging are having to pay a lot more than if they had borrowed the same amount a few years ago.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027.

A hold in interest rates may have relatively little impact on pricing of fixed-rate mortgages in the short-term. The outlook is complicated at the moment as the markets, and lenders, consider the impact of the Budget and other global events.

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if decisions by the Bank of England make borrowing costs cheaper. However, this tends to happen very slowly.

Getty Images

Getty ImagesSavings

The Bank of England interest rate also affects how much savers earn on their money.

A falling base rate is likely see a reduction in the returns offered to savers by banks and building societies. The current average rate for an easy access account is about 3% a year.

Any cut could particularly affect those who take the interest from savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 - the group representing the world's seven largest so-called "advanced" economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%. After a series of cuts it now stands at 3%.

In the US, the central bank - the Federal Reserve - has cut interest rates for three meetings in a row. Its key lending rate is now in a target range of 4.25% to 4.5%, but the Fed has indicated that it will cut rates at a slower pace next year.