Bitcoin: Does it really use more electricity than Ireland?

Getty Images

Getty ImagesCan something which has no physical presence consume as much electricity as an entire country?

The internet has recently been awash with claims that the digital currency Bitcoin could be using more electricity than a number of developed nations. So Reality Check wants to know: how did they work it out, and is it true?

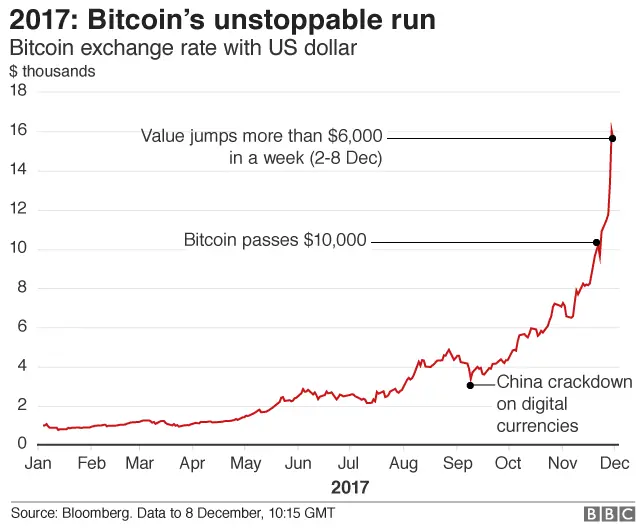

Although it has been around since 2009, the digital currency, or crypto-currency, has been dominating headlines across the globe recently thanks to its soaring value.

Unlike the notes or coins in your pocket, Bitcoin is not printed by governments or traditional banks and largely exists online.

Around 3,600 new bitcoins are created every day through a complex process known as "mining", where computers are rewarded with a bitcoin for processing mathematical equations through specialised software.

Except this isn't only a handful of computers processing these equations, but thousands of machines all over the world running day and night - that's a lot of electricity.

And as bitcoins increase in value, more and more machines are being plugged in and switched on by amateurs and professionals alike to mine them.

Given their digital nature, there's understandably been a growing curiosity about how much electricity is actually being used to produce bitcoins.

'As much electricity as Denmark'

Social media platforms such as Twitter are unsurprisingly full of claims about Bitcoin's energy consumption.

Allow X content?

Allow X content?

So are comparisons like this accurate?

The short answer is that it's very difficult to say, as there are no recognised authoritative sources on energy usage for digital currencies like Bitcoin.

Its peer-to-peer nature makes it very difficult to get an overview of anything other than the value of the digital currency itself.

Operational costs

But people have tried. A widely-used formula to calculate energy consumption is from the crypto-currency blog Digiconomist, which relies on the performance specifications of common mining technology.

It takes total mining revenues as a starting point, estimates the operational costs to miners as a percentage of their revenues, and then converts these costs into energy consumption based on average electricity prices.

According to this method, Bitcoin's current annual electricity consumption is estimated to be 32.56 terawatt hours (TWh).

This is how comparisons with entire countries are being made.

For example, data from Eurostat shows that in 2015, Denmark consumed 30.7 TWh of electricity and the Republic of Ireland consumed 25.07 TWh.

So if we are to use this measure, then yes, you could argue that the comparisons on Twitter are broadly correct.

But as this method uses assumptions and estimations, something that Digiconomist readily admits, it should come as no surprise that it is not without its critics.

One analyst, Marc Bevand, argues this method is wrong because it does not take into account newer and more energy-efficient technology employed by miners, adding it makes "the wrong assumption that a fixed '60%' of mining revenues are spent on electricity".

When American business magazine Forbes reported at the end of October that Bitcoin's estimated market capitalisation value - the overall worth of a tradable entity - had surpassed those of household names such as Goldman Sachs and eBay, it was inevitable that the crypto-currency would soon become subject to comparisons with entire countries.

But regardless of how you choose to measure the energy consumption of Bitcoin and other digital currencies, there remains at least one area for consensus.

As with any product - digital or physical - its future will ultimately be determined by how cost-effective it is to produce.

The total number of bitcoins in circulation currently stands at 16.7 million, which will continue to rise until it reaches 21 million - the total supply set by the currency's rules.

So long as electricity remains cheap and reliable, the technology readily available, and the value of the digital currency high enough to easily absorb production costs, Bitcoin is likely to continue to generate headlines until it reaches its maximum circulation.