Will Australia's 'miracle economy' keep on winning?

Getty Images

Getty ImagesIt was the year Australia went to war in the Gulf, when Monica Seles and Boris Becker won tennis grand slams in Melbourne, and The Simpsons was first shown on Aussie television, while a swooning Bryan Adams was a hit with love-struck teenagers ("Look into your heart, baby").

It was 1991, and the last time Australia tasted the bitter economic taste of recession, defined in these parts, at least, as two or more back-to-back quarters of negative growth in real gross domestic product, or the value of all services and goods.

Since then, Australia has sidestepped the worst effects of the Asian financial crisis in 1997 and its more destructive big brother that hammered global markets a decade or so later.

Australia's economy - the "wonder down under" - has somehow dodged the unstoppable forces that sent other wealthy countries tumbling into reverse.

For this, a nation of 24 million people must thank not only sound judgement by those in charge but also good fortune, according to Shane Oliver, chief economist at financial services company AMP in Sydney.

"I certainly don't see Australia as being a miracle," he says. "It has had a bit of good luck and good management, but it would be dangerous to assume that it is never going to have a recession again."

Getty Images

Getty ImagesThe economy is growing by about 1.9% per year, according to the Reserve Bank. In 2012, that figure was 3.7%. Weaker growth means that pay packets are shrinking for many workers when adjusted for the rising cost of living, and near-record levels of underemployment are stifling wage increases.

In August, retail sales posted their biggest retreat in about four-and-a-half years, falling by 0.6%, with cafes and restaurants reporting declining turnovers.

Period of transition?

Rocks, coal and demand from China insulated this country from the global financial meltdown in 2008, as a red-hot mining industry delivered unprecedented wealth.

Surging commodity prices fuelled the bonanza in Western Australia and Queensland, which propped up under-performing states in the south-east, where most Australians live.

Shane Oliver says the situation has now "been turned on its head" and Australia is once again in transition.

The mining boom has faded, but areas that once struggled have bounced back in part because of record low interest rates that have unleashed a frenzy into the housing market.

Getty Images

Getty ImagesMeanwhile, eye-watering wads of public money have poured into infrastructure projects, which are redefining parts of New South Wales, the most populous state.

There was another critical factor that helped Australia to largely avoid the ravages of the global financial crisis - unprecedented spending by the Labor government that boosted public expenditure by a whopping 13% in an attempt to stimulate growth.

It was a classic Keynesian economic manoeuvre to use billions of dollars to sustain household spending, demand and employment.

Australia loves to win. Here international cricket matches are akin to "wars" and Olympic gold medals - or a lack thereof - are greeted with congratulatory back-slapping - or hand-wringing.

If there was a podium for economic success, this is a country that would be bending forward to accept the award. More than 25 years of uninterrupted growth is a remarkable achievement, although there is debate about the competition.

Some commentators believe the recent economic prosperity enjoyed by the Netherlands lasted for (only) 22 years, putting it firmly into silver medal position behind the Aussies.

Right place, right time

Tim Harcourt, an economics fellow at the University of New South Wales, believes Australia deserves the plaudits.

"This time the 'lucky country' made its own luck.

"The Hawke-Keating [government] reforms of the 1980s and 1990s - the currency float, tariff changes, and embrace of Asia - set up us up for a quarter of a century of growth.

"Australia found itself in the right place at the right time and embraced the Asia century," he argues.

Getty Images

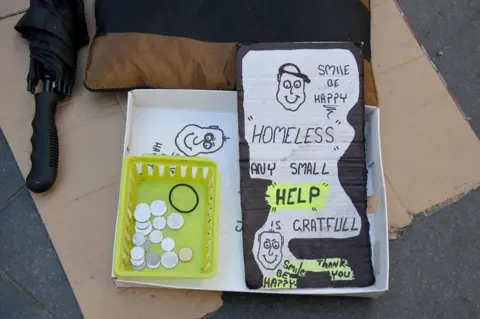

Getty ImagesBut as the economy has soared, some Australians have been left behind. At almost 13%, youth unemployment is more than twice the national average.

Labouring work had left 21-year-old Mohammad Al-Khafaji, the son of an Iranian refugee, with endless back pain and homelessness soon followed.

"I was just trying to apply for jobs online, and then people were just putting me down saying 'you are never going to get that job', so I just stopped trying," he says.

'Muddling along'

Mohammad is now employed by a hire car company in Sydney, and has ambitions to one day be the boss.

He works with Shiv Dhingra, an Indian migrant from Punjab. They are proof that much of Australia's economic might is down to immigration.

"I am the only one working in my family," Shiv explained. "I am the main financial support they have. I am working seven days a week for the last year. I've got plans for my own business."

Charity Bounce

Charity BounceBoth young men were helped by Charity Bounce, a Sydney-based non-profit organisation that uses basketball to reach out to the disadvantaged and long-term unemployed, who, according to chief executive, Ian Heininger, also deserve a slice of Australia's prosperity.

"We find a lot of the young people are desperate to find work," he says, "desperate to find an opportunity that is going to get them into a place where they are contributing back to the world."

But will they be part of an ever-expanding economy? Mr Oliver thinks Australia's luck will eventually run out, but not for a while.

"The Aussie economy is probably going to continue muddling along, not fantastically strong as housing slows and consumer spending remains a bit weak," he predicts.

"We are probably going to go for at least another few years before we have that recession some people say is inevitable."